年化50%跨所价差套利实战教学

本人管理目前10m资金做套利

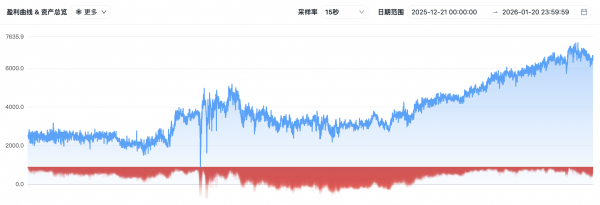

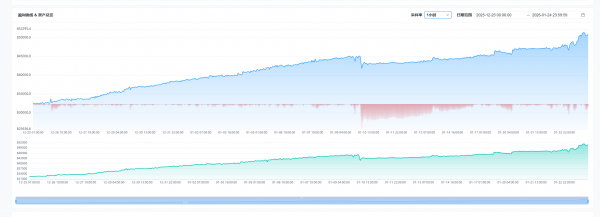

这是我一个实盘的资金曲线

所以接下来的内容绝对干货

什么是跨所价差套利?

某品种,在A交易所:Ask1报价为99,而在B交易所:Bid1报价为101。

此时,你在A交易所买入,与卖一撮合,成交价为99

在B交易所卖出,与买一撮合,成交价为101

你就锚定了这101-99的差价,在扣除A和B的手续费后还有利可图,那么这就是个套利机会

不少现货交易所的价差可以达到20-30%

每次来黑天鹅你总能听到某某搬价差赚到了多少多少钱

是不是让你很心动?

听起来很简单,其实要解决的问题,很多:

- 如何知道最快的行情,如何最快的执行下单

- 订单类型如何选择:市价?Maker?IOC?

- 手续费如何最低

- 价差不回归怎么办

- 价差盈利资金费率亏损怎么办

- 单边爆仓怎么办

- 怎么避免ADL

- 交易所拉闸变成单机币怎么办

- 交易所改规则Tick精度变化怎么办

等等等等,都是跨所需要考虑的事情,这些细节风控,在我的团队我已经列出来40多条需要做的风控尽调。

由于篇幅太长,本文会讲解第一条和第二条如何实现的实战教学。

关注我,我以后会更新教学如何现货不提币变相套利的两招

以及Maker三角套利等等

我做过的套利策略:站内期限、三角套利、跨所价差、跨所Maker后Taker、精度套利

当年我用20万,日化1%,做套利半年滚到了100万,那个时代已经过去了

现在只有流动性特别低的小所和黑天鹅才会有这么高的收益

不过据我所知,在现货、链上,还是有人可以做到1m以上资金年化100%

实战

工具:OpenQuant高频交易系统(openquant.cc)

(Rust写的交易系统,可以最快的实现事件行情订阅驱动策略、Ws下单、Cookie下单、绑定机构id、自动化处理交易所价格精度、步长、面值等工程问题。使用最少的代码即可写出一个可行的价差套利策略)

服务器:东京Aws服务器 500MB内存足矣

(这个不用解释,大部分交易所都在Aws东京)

1. 极速行情的获取:Tick 级驱动

高频策略的本质是数据流处理。传统轮询行情太慢,但完全依赖推送又容易处理不过来。OpenQuant 允许我们针对不同类型的数据,配置不同的处理模式。

在 subscribes 方法中,我们首先要解决这三种数据流的订阅:

-

极速行情(BBO):使用 Latest 模式。高频场景下,100ms 前的报价是垃圾。如果策略处理不过来,系统自动丢弃积压包,永远只喂给策略最新的 Tick。

-

订单回报(Order):使用 Async 模式。订单状态绝对不能丢,否则会导致状态机错乱。

-

资金查询(Timer):使用 Timer 轮询。依靠 WS 推送余额往往不稳定。为了确保下单前保证金校验(Risk Check)准确,我们单独开一个定时器,每 3 秒主动查一次余额,更新本地状态。

def subscribes(self):

"""

配置数据流订阅

"""

subs = []

account_ids = {exchange['exchange']: idx for idx, exchange in enumerate(self.cex_configs)}

# 1. 行情流:BBO -> Latest 模式 (只看最新,丢弃过时包)

for exchange in [self.high_liq_exchange, self.low_liq_exchange]:

subs.append({

"account_id": account_ids[exchange],

"event_handle_mode": "Latest",

"sub": {

"SubscribeWs": [{"Bbo": [self.symbol]}]

}

})

# 2. 交易流:Order -> Async 模式 (队列处理,确保不漏单)

for exchange in [self.high_liq_exchange, self.low_liq_exchange]:

subs.append({

"account_id": account_ids[exchange],

"event_handle_mode": "Async",

"sub": {

"SubscribeWs": [{"Order": [self.symbol]}]

}

})

# 3. 风控流:Balance -> Timer 模式 (每3秒主动轮询)

subs.append({

"account_id": 0,

"sub": {

"SubscribeTimer": {

"update_interval": {"secs": 3, "nanos": 0},

"name": "QueryBalance"

}

}

})

return subs2. 核心逻辑:计算与触发

当行情推送到 on_bbo 回调时,我们不做任何复杂的预测,只做最简单的数学题。

这里我们定义了两个角色:

- 高流动性所 :如 Binance 等,深度好,价格稳,滑点低,作为行情的锚点。

- 低流动性所 :中小交易所流动性更差,更容易出现短暂的价差机会。

代码逻辑非常直观:

def _check_and_trade(self):

# 计算方向:低流动性所开仓,高流动性所平仓

# Spread = (Bid_H - Ask_L) / Ask_L

buy_low_spread = (self.high_liq_bid - self.low_liq_ask) / self.low_liq_ask

# 扣除双边 Taker 手续费

total_fee = self.low_liq_taker_fee + self.high_liq_taker_fee

net_spread = buy_low_spread - total_fee

# 只有当净价差大于我们设定的阈值(例如万2)时,才触发交易

if net_spread > self.spread_threshold:

# 触发低流所开仓流程

self._execute_arbitrage(is_buy_low=True, spread=net_spread)

3. 订单与先后顺序

如果你用普通的限价单,可能永远挂在盘口吃不到单,或者吃单之后早已错过了套利时机;如果你用市价单,滑点可能会吃掉你所有的利润。

所以对于开仓而言的最优解是使用 IOC 订单:要么立即成交,要么取消,绝不挂单等待。

此外,下单顺序至关重要。低流动性所的机会转瞬即逝,且一般是跟随、落后于高流动性所的,因此先打低流动性所的 IOC 单,在保证滑点可控的情况下吃到货,然后立刻去高流动性所对冲。

def _execute_arbitrage(self, is_buy_low: bool, spread: float):

# 价格计算:买单加滑点,卖单减滑点,保证成交率

# ioc_slippage 设置为 0.0001 (万1)

if is_buy_low:

low_liq_price = self.low_liq_ask * (1 + self.ioc_slippage)

else:

low_liq_price = self.low_liq_bid * (1 - self.ioc_slippage)

# 构造 IOC 订单

order = {

"symbol": self.symbol,

"side": "Buy" if is_buy_low else "Sell",

"order_type": "Limit", # 限价单配合IOC模式

"amount": self.trade_amount,

"price": low_liq_price,

"time_in_force": "IOC", # 立即成交或取消,不挂单

"cid": cid

}

# 异步发送,不阻塞策略线程

self.trader.place_order(..., order=order, sync=False)

# 打开对冲开关

self.pending_high_liq_order = True

self.pending_high_liq_side = "Sell" if is_buy_low else "Buy"

在这个逻辑中,我们利用 OpenQuant 自动处理了最麻烦的精度对齐和最小下单量检查,代码里只需要关注“买卖”本身。

4. 闭环:极速回调对冲

这才是 OpenQuant 相比轮询框架最大的优势。我们不在发单后死等,而是通过 on_order 回调监听。

一旦收到低流动性所的 Filled 状态,毫秒级内自动触发高流动性所(Binance)的对冲单。

def on_order(self, account_id, order):

"""

订单状态推送回调

"""

# ... 解析 order_info ...

# 核心逻辑:如果是低流所成交,且处于等待对冲状态

if (order_info["exchange"] == self.low_liq_exchange and

filled > 0 and

self.pending_high_liq_order):

# 立即执行对冲逻辑

self._place_high_liq_order(filled)

def _place_high_liq_order(self, amount):

"""

在高流动性所(Binance)执行对冲

"""

# 计算对冲价格:同样给滑点,确保必定成交

is_buy = (self.pending_high_liq_side == "Buy")

price = self.high_liq_ask * (1.0001) if is_buy else self.high_liq_bid * (0.9999)

order = {

"symbol": self.symbol,

"side": self.pending_high_liq_side,

"order_type": "Limit",

"amount": amount, # 对冲数量严格等于成交数量

"price": price,

"time_in_force": "IOC",

"cid": trader.create_cid(self.high_liq_exchange)

}

# 发送对冲单

self.trader.place_order(..., order=order, sync=False)

self.pending_high_liq_order = False

5. 现实的复杂性

实盘就是不断解决这些问题的过程。下面是我们的跨所套利策略在 OpenQuant 上实际运行的盈利曲线抓拍。可以看到,得益于 OpenQuant Rust 底层的低延迟,我们可以成功捕捉到两腿之间极其微小的价差,积少成多,获得 50% 的年化收益率。

OpenQuant 的初衷就是解决那些繁琐的工程问题,让策略开发者能像写上面的 Python 代码一样,专注于策略逻辑本身。最基础的代码演示附在了最后,如果你对高频套利感兴趣,可以参考它,在它的基础上不断完善,形成自己专属的跨所套利策略。

完整代码:

"""

简单跨所套利策略 - 教学示例

年化50%跨所价差套利实战教学

"""

import time

import traderv2 as trader # type: ignore

from base_strategy import BaseStrategy

class Strategy(BaseStrategy):

def __init__(self, cex_configs, dex_configs, strategy_config, trader_instance: trader.TraderV2):

self.log = trader_instance.log

self.trader = trader_instance

self.strategy_config = strategy_config

self.cex_configs = cex_configs

self.orders = {} # cid -> order_info

self.pending_high_liq_order = False

self.pending_high_liq_side = None

self.current_round_orders = []

self.total_trades = 0

self.total_pnl = 0.0

self.high_liq_ask = 0.0

self.high_liq_bid = 0.0

self.low_liq_ask = 0.0

self.low_liq_bid = 0.0

self.instruments = {}

# 存储余额信息

self.high_liq_balance = None

self.low_liq_balance = None

def name(self):

return self.strategy_config["name"]

def start(self):

"""策略启动"""

# 配置参数

self.high_liq_exchange = self.strategy_config["high_liquidity_exchange"]

self.low_liq_exchange = self.strategy_config["low_liquidity_exchange"]

self.symbol = self.strategy_config["symbol"]

self.spread_threshold = self.strategy_config.get("spread_threshold", 0.0002)

self.trade_amount = self.strategy_config.get("trade_amount", 100.0)

self.ioc_slippage = self.strategy_config.get("ioc_slippage", 0.0001)

self.min_balance_ratio = self.strategy_config.get("min_balance_ratio", 0.3)

self.leverage = self.strategy_config.get("leverage", 5)

# 获取账户ID

account_ids = {exchange['exchange']: idx for idx, exchange in enumerate(self.cex_configs)}

self.high_liq_account_id = account_ids[self.high_liq_exchange]

self.low_liq_account_id = account_ids[self.low_liq_exchange]

# 获取交易对信息

self._load_instruments()

# 获取手续费(优先从配置读取,读不到则从API查询)

self._load_fee_rates()

# 设置杠杆

self._set_leverage()

# 初始化余额

self._load_balances()

self.log(f"策略启动成功!", level="INFO", color="green")

self.log(f"高流动性所: {self.high_liq_exchange}", level="INFO")

self.log(f"低流动性所: {self.low_liq_exchange}", level="INFO")

self.log(f"交易品种: {self.symbol}", level="INFO")

self.log(f"价差阈值: {self.spread_threshold:.4%}", level="INFO")

self.log(f"交易数量: {self.trade_amount}", level="INFO")

self.log(f"杠杆倍数: {self.leverage}x", level="INFO")

def _load_instruments(self):

"""加载交易对信息"""

for account_id, exchange in [(self.high_liq_account_id, self.high_liq_exchange),

(self.low_liq_account_id, self.low_liq_exchange)]:

result = self.trader.get_instrument(account_id, self.symbol)

time.sleep(0.1)

if "Ok" in result:

self.instruments[exchange] = result["Ok"]

self.log(f"{exchange} 交易对信息加载成功", level="INFO")

else:

raise Exception(f"获取 {exchange} 交易对信息失败: {result.get('Err')}")

def _load_fee_rates(self):

"""加载手续费率"""

accounts_config = self.strategy_config.get("accounts", [])

if len(accounts_config) > max(self.high_liq_account_id, self.low_liq_account_id):

high_liq_config = accounts_config[self.high_liq_account_id]

low_liq_config = accounts_config[self.low_liq_account_id]

self.high_liq_taker_fee = high_liq_config.get("taker_fee")

self.low_liq_taker_fee = low_liq_config.get("taker_fee")

else:

self.high_liq_taker_fee = None

self.low_liq_taker_fee = None

if self.high_liq_taker_fee is None:

result = self.trader.get_fee_rate(self.high_liq_account_id, self.symbol)

time.sleep(0.1)

if "Ok" in result:

self.high_liq_taker_fee = result["Ok"].get("taker", 0.0005)

self.log(f"{self.high_liq_exchange} 手续费率(API查询): {self.high_liq_taker_fee:.6f}",

level="INFO")

else:

self.high_liq_taker_fee = 0.0005

self.log(f"{self.high_liq_exchange} 手续费率查询失败,使用默认值", level="WARN")

if self.low_liq_taker_fee is None:

result = self.trader.get_fee_rate(self.low_liq_account_id, self.symbol)

time.sleep(0.1)

if "Ok" in result:

self.low_liq_taker_fee = result["Ok"].get("taker", 0.0005)

self.log(f"{self.low_liq_exchange} 手续费率(API查询): {self.low_liq_taker_fee:.6f}",

level="INFO")

else:

self.low_liq_taker_fee = 0.0005

self.log(f"{self.low_liq_exchange} 手续费率查询失败,使用默认值", level="WARN")

def _set_leverage(self):

"""设置杠杆倍数"""

for account_id, exchange in [(self.high_liq_account_id, self.high_liq_exchange),

(self.low_liq_account_id, self.low_liq_exchange)]:

result = self.trader.set_leverage(account_id, self.symbol, self.leverage)

time.sleep(0.1)

if "Ok" in result:

self.log(f"{exchange} 设置杠杆 {self.leverage}x 成功", level="INFO", color="green")

else:

self.log(f"{exchange} 设置杠杆失败: {result.get('Err')}", level="WARN", color="yellow")

def _load_balances(self):

"""初始化余额"""

high_result = self.trader.get_usdt_balance(self.high_liq_account_id)

time.sleep(0.1)

if "Ok" in high_result:

self.high_liq_balance = high_result["Ok"]

self.log(f"{self.high_liq_exchange} 余额加载成功: 可用 {self.high_liq_balance.get('available_balance', 0):.2f} USDT",

level="INFO")

else:

self.log(f"{self.high_liq_exchange} 余额加载失败: {high_result.get('Err')}", level="WARN", color="yellow")

low_result = self.trader.get_usdt_balance(self.low_liq_account_id)

time.sleep(0.1)

if "Ok" in low_result:

self.low_liq_balance = low_result["Ok"]

self.log(f"{self.low_liq_exchange} 余额加载成功: 可用 {self.low_liq_balance.get('available_balance', 0):.2f} USDT",

level="INFO")

else:

self.log(f"{self.low_liq_exchange} 余额加载失败: {low_result.get('Err')}", level="WARN", color="yellow")

def subscribes(self):

"""订阅配置"""

account_ids = {exchange['exchange']: idx for idx, exchange in enumerate(self.cex_configs)}

subs = []

# 订阅 BBO - Latest 模式

for exchange in [self.high_liq_exchange, self.low_liq_exchange]:

subs.append({

"account_id": account_ids[exchange],

"event_handle_mode": "Latest",

"sub": {

"SubscribeWs": [{"Bbo": [self.symbol]}]

}

})

# 订阅订单更新 - Async 模式

for exchange in [self.high_liq_exchange, self.low_liq_exchange]:

subs.append({

"account_id": account_ids[exchange],

"event_handle_mode": "Async",

"sub": {

"SubscribeWs": [{"Order": [self.symbol]}]

}

})

# 定时查询余额

subs.append({

"account_id": 0,

"sub": {

"SubscribeTimer": {

"update_interval": {"secs": 3, "nanos": 0},

"name": "QueryBalance"

}

}

})

return subs

def on_bbo(self, exchange, bbo):

"""BBO 更新回调"""

# 更新价格

if exchange == self.high_liq_exchange:

self.high_liq_ask = bbo["ask_price"]

self.high_liq_bid = bbo["bid_price"]

elif exchange == self.low_liq_exchange:

self.low_liq_ask = bbo["ask_price"]

self.low_liq_bid = bbo["bid_price"]

# 检查价差

if self.high_liq_ask > 0 and self.low_liq_ask > 0:

self._check_and_trade()

def _check_and_trade(self):

"""检查价差并执行交易"""

if self.pending_high_liq_order or len(self.orders) > 0:

return

buy_low_spread = (self.high_liq_bid - self.low_liq_ask) / self.low_liq_ask

sell_low_spread = (self.low_liq_bid - self.high_liq_ask) / self.high_liq_ask

total_fee = self.low_liq_taker_fee + self.high_liq_taker_fee

buy_low_spread -= total_fee

sell_low_spread -= total_fee

if buy_low_spread > self.spread_threshold:

self._execute_arbitrage(is_buy_low=True, spread=buy_low_spread)

elif sell_low_spread > self.spread_threshold:

self._execute_arbitrage(is_buy_low=False, spread=sell_low_spread)

def _execute_arbitrage(self, is_buy_low: bool, spread: float):

"""执行套利交易"""

if not self._check_balance():

return

if is_buy_low:

low_liq_price = self.low_liq_ask * (1 + self.ioc_slippage)

else:

low_liq_price = self.low_liq_bid * (1 - self.ioc_slippage)

cid = trader.create_cid(self.low_liq_exchange)

order = {

"symbol": self.symbol,

"side": "Buy" if is_buy_low else "Sell",

"order_type": "Limit",

"amount": self.trade_amount,

"price": low_liq_price,

"time_in_force": "IOC",

"pos_side": "Long" if is_buy_low else "Short",

"cid": cid

}

params = {

"is_dual_side": False,

"margin_mode": "Cross"

}

order_info = {

"exchange": self.low_liq_exchange,

"side": "Buy" if is_buy_low else "Sell",

"amount": self.trade_amount,

"price": low_liq_price,

"filled": 0.0,

"avg_price": 0.0,

"status": "Pending"

}

self.orders[cid] = order_info

result = self.trader.place_order(

account_id=self.low_liq_account_id,

order=order,

params=params,

sync=False

)

if "Ok" in result:

self.log(f"<b>发现套利机会!</b> 价差: {spread:.8%}", level="INFO", color="green")

self.log(f"步骤1: {self.low_liq_exchange} {'买入' if is_buy_low else '卖出'} "

f"{self.trade_amount} @ {low_liq_price:.5f}", level="INFO", color="green")

self.pending_high_liq_order = True

self.pending_high_liq_side = "Sell" if is_buy_low else "Buy"

else:

del self.orders[cid]

self.log(f"下单失败: {result.get('Err')}", level="ERROR", color="red")

def _check_balance(self) -> bool:

"""检查余额是否充足(直接读取已存储的余额)"""

if not self.high_liq_balance or not self.low_liq_balance:

return False

high_available = self.high_liq_balance.get("available_balance", 0.0)

low_available = self.low_liq_balance.get("available_balance", 0.0)

trade_value = self.trade_amount * max(self.high_liq_ask, self.low_liq_ask)

margin_needed = trade_value / self.leverage

if high_available < margin_needed / self.min_balance_ratio:

self.log(f"高流动性所余额不足", level="WARN", color="yellow")

return False

if low_available < margin_needed / self.min_balance_ratio:

self.log(f"低流动性所余额不足", level="WARN", color="yellow")

return False

return True

def on_order_submitted(self, account_id, order_id_result, order):

"""订单提交回调"""

cid = order.get("cid")

if not cid or cid not in self.orders:

return

order_info = self.orders[cid]

if "Err" in order_id_result:

self.log(f"订单提交失败: {order_id_result['Err']}", level="ERROR", color="red")

order_info["status"] = "Rejected"

del self.orders[cid]

else:

order_id = order_id_result["Ok"]

order_info["order_id"] = order_id

order_info["status"] = "Submitted"

self.log(f"订单提交成功: {order_id}", level="INFO", color="green")

def on_order(self, account_id, order):

"""订单更新回调"""

cid = order.get("cid")

if not cid or cid not in self.orders:

return

order_info = self.orders[cid]

status = order.get("status", "")

filled = order.get("filled", 0.0)

filled_avg_price = order.get("filled_avg_price", 0.0)

order_info["status"] = status

order_info["filled"] = filled

if filled > 0:

order_info["avg_price"] = filled_avg_price

if (order_info["exchange"] == self.low_liq_exchange and

filled > 0 and

self.pending_high_liq_order and

not order_info.get("high_liq_placed")):

order_info["high_liq_placed"] = True

self._place_high_liq_order(filled)

if status in ["Filled", "Canceled"]:

self.log(f"{order_info['exchange']} 订单完成: {status}, "

f"成交 {filled} @ {filled_avg_price:.5f}",

level="INFO", color="green")

if filled > 0:

self.current_round_orders.append({

"exchange": order_info["exchange"],

"side": order_info["side"],

"filled": filled,

"avg_price": filled_avg_price

})

del self.orders[cid]

if len(self.orders) == 0 and not self.pending_high_liq_order:

self._settle_round()

def _place_high_liq_order(self, low_liq_filled_amount):

"""下高流动性所订单"""

if not self.pending_high_liq_order:

return

is_buy = (self.pending_high_liq_side == "Buy")

if is_buy:

price = self.high_liq_ask * (1 + self.ioc_slippage)

else:

price = self.high_liq_bid * (1 - self.ioc_slippage)

cid = trader.create_cid(self.high_liq_exchange)

order = {

"symbol": self.symbol,

"side": self.pending_high_liq_side,

"order_type": "Limit",

"amount": low_liq_filled_amount,

"price": price,

"time_in_force": "IOC",

"pos_side": "Long" if self.pending_high_liq_side == "Buy" else "Short",

"cid": cid

}

params = {

"is_dual_side": False,

"margin_mode": "Cross"

}

order_info = {

"exchange": self.high_liq_exchange,

"side": self.pending_high_liq_side,

"amount": low_liq_filled_amount,

"price": price,

"filled": 0.0,

"avg_price": 0.0,

"status": "Pending"

}

self.orders[cid] = order_info

result = self.trader.place_order(

account_id=self.high_liq_account_id,

order=order,

params=params,

sync=False

)

if "Ok" in result:

self.pending_high_liq_order = False

self.log(f"步骤2: {self.high_liq_exchange} {self.pending_high_liq_side} "

f"{low_liq_filled_amount} @ {price:.5f}", level="INFO", color="green")

else:

del self.orders[cid]

self.pending_high_liq_order = False

self.log(f"高流动性所下单失败: {result.get('Err')}", level="ERROR", color="red")

def _settle_round(self):

"""结算本轮交易"""

if len(self.current_round_orders) != 2:

self.current_round_orders.clear()

return

# 计算盈亏

buy_cost = 0.0

sell_revenue = 0.0

for order in self.current_round_orders:

value = order["filled"] * order["avg_price"]

fee_rate = 0.0

if order["exchange"] == self.high_liq_exchange:

fee_rate = self.high_liq_taker_fee

elif order["exchange"] == self.low_liq_exchange:

fee_rate = self.low_liq_taker_fee

if order["side"] == "Buy":

buy_cost += value * (1 + fee_rate)

else:

sell_revenue += value * (1 - fee_rate)

pnl = sell_revenue - buy_cost

pnl_pct = (pnl / buy_cost * 100) if buy_cost > 0 else 0

self.total_trades += 1

self.total_pnl += pnl

# 输出报告

report = f"<b>═══ 第 {self.total_trades} 轮套利完成 ═══</b><br>"

report += f"本轮盈亏: <b>{pnl:.4f} USDT</b> ({pnl_pct:+.4f}%)<br>"

report += f"交易明细:<br>"

for i, order in enumerate(self.current_round_orders):

report += f" {i+1}. {order['exchange']} {order['side']} "

report += f"{order['filled']} @ {order['avg_price']:.5f}<br>"

self.log(report, level="INFO", color="green")

self.current_round_orders.clear()

def on_timer_subscribe(self, timer_name):

"""定时器回调"""

if timer_name == "QueryBalance":

# 查询余额并存储(每3秒)

high_result = self.trader.get_usdt_balance(self.high_liq_account_id)

low_result = self.trader.get_usdt_balance(self.low_liq_account_id)

if "Ok" in high_result:

self.high_liq_balance = high_result["Ok"]

if "Ok" in low_result:

self.low_liq_balance = low_result["Ok"]

def on_stop(self):

"""策略停止"""

self.log(f"策略停止,累计交易: {self.total_trades} 轮,"

f"累计盈亏: {self.total_pnl:.4f} USDT",

level="INFO", color="green")

time.sleep(1)